-

Sinking Fund Ballot Language

This is the board resolution approving actual ballot language to restore the Sinking Fund for five more years.

-

Operating Millage Ballot Language

This is the actual ballot language to reauthorize the Operating Millage for five more years.

Frequently Asked Questions

-

When is the election?

When is the election?

The election is Tuesday, November 5, 2019. The polls will be open from 7 a.m. until 8 p.m. Absentee ballots will be available after September 21.

-

What is on the ballot?

What is on the ballot?

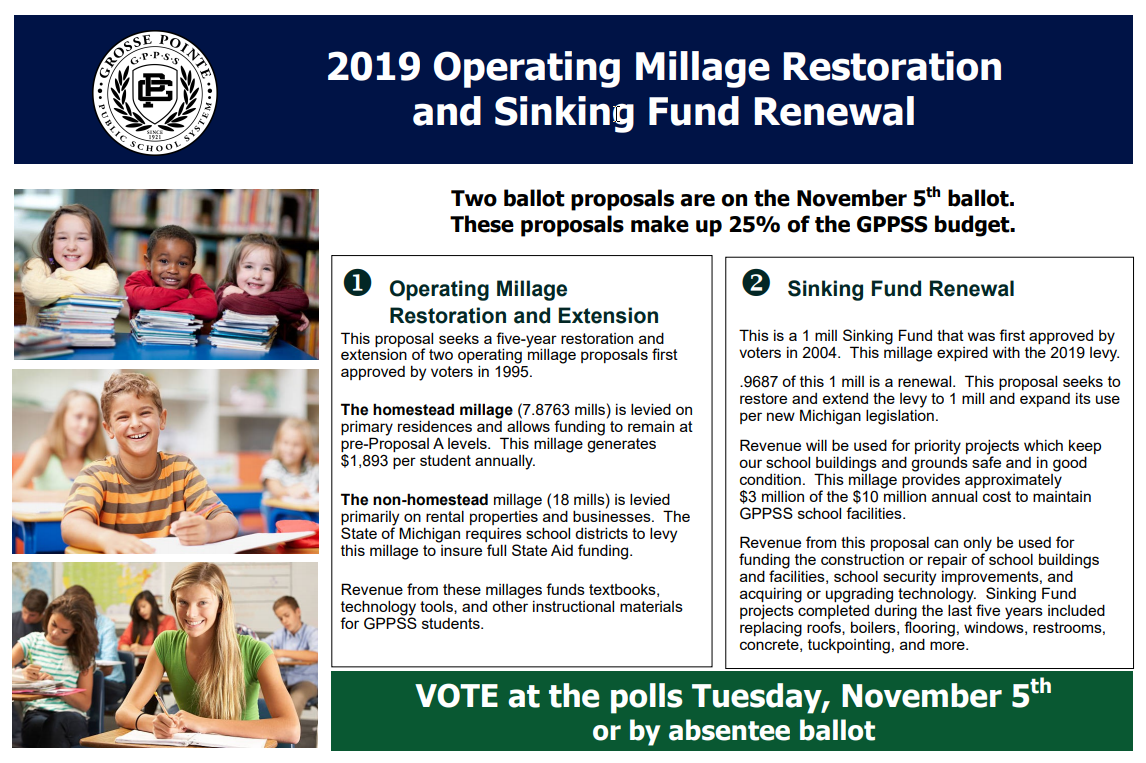

Registered voters residing within the boundaries of the Grosse Pointe Public School System (GPPSS) will vote on two millage proposals.

The first millage proposal is an Operating Millage Restoration and Extension (a homestead and non-homestead operating millage) that was first approved by voters in 1995.

The second millage proposal is a one mill sinking fund proposal that was first approved by voters in 2004. This millage expired with the 2019 levy. Voter approval of this proposal will extend the term and expand the purpose of the sinking fund and restore the authorization to one mill after a Headlee rollback.

-

What is included in each ballot proposal?

What is included in each ballot proposal?

The first millage proposal is an Operating Millage Restoration and Extension millage. It has two components:

the homestead millage (7.8763 mills) that is levied on primary residences and allows the school district to receive its full funding allowanced from the State of Michigan; and,

the non-homestead millage (18 mills) is levied primarily on rental properties and businesses. The State of Michigan requires school districts to levy this millage to insure full State Aid funding. Nineteen (19) mills is requested so that with Headlee rollbacks of up to one mill, the full 18 mills can be levied.

The second millage proposal is a one mill sinking fund proposal that was first approved by voters in 2004. This millage expired with the 2019 levy. Voter approval of this proposal will extend and restore the sinking fund and allows the school district to use sinking fund proceeds for expanded purposes, including security and technology equipment.

-

Why has the school district scheduled this millage election?

Why has the school district scheduled this millage election?

The prior operating millage authority expired with the 2019 levy. In addition, revenue from the voter approved operating millage has been reduced per requirements of the Headlee Amendment to the Michigan Constitution. The school district is seeking to prevent losing revenue by restoring and extending the millage to the levels previously approved by voters.

The Sinking Fund millage expired with the 2019 levy. Since it was first approved in 2004, a request for renewal of the Sinking Fund millage has been brought back to voters for renewal every five years. This year the school district is seeking approval to extend the levy, restore the levy to one mill after a Headlee rollback and expand its use to include technology and security equipment which is why the proposal is characterized as an extension and restoration.

-

How much revenue do the two proposals generate annually?

How much revenue do the two proposals generate annually?

The Operating Millage Restoration and Extension would raise approximately $22,283,000 in the first year of levy. This millage currently makes up 25% of the school district’s budget. Revenue from this millage funds program costs, textbooks, technology tools, and other instructional materials for GPPSS students.

The Sinking Fund proposal generates approximately $3 million of the $10 million annual cost to maintain GPPSS school facilities. The Sinking Fund is used to keep school grounds and buildings safe and in good condition.

-

In previous years, what types of projects have been completed using Sinking

Fund revenue?

In previous years, what types of projects have been completed using Sinking

Fund revenue?

Sinking Fund revenue has provided funding for facility repair and replacement projects within the GPPSS. During the last five years, projects have included replacing roofs, boilers, flooring, windows, restrooms, concrete, and tuckpointing.

-

How do the restoration and renewals address the educational needs of the

GPPSS?

How do the restoration and renewals address the educational needs of the

GPPSS?

The November 5th Operating Millage Restoration and Extension Proposal will continue to support the delivery of the GPPSS instructional program. It will support program costs, textbooks, technology tools, and other instructional materials for GPPSS students. The Sinking Fund allows the school district to focus more of the general fund on student instruction.

-

What will appear on the November 5th ballot?

What will appear on the November 5th ballot?

Here is the exact ballot wording:

GROSSE POINTE PUBLIC SCHOOL SYSTEM

OPERATING MILLAGE RESTORATION AND EXTENSION

This proposal would reauthorize the Grosse Pointe Public School System to levy up to 18.00 mills for general school district operating purposes on taxable property in the School District to the extent that such property is not exempt from such levy, protect the School District against the impact of Headlee rollbacks of up to 1.0 mill, and restrict the levy on principal residences (owner-occupied homes) to no more than 7.8763 mills. This authorization would allow the School District to continue to levy the statutory limit of 18.00 mills on non-homestead (principally industrial and commercial real property and residential rental property) which expired with the School District's 2019 tax levy . Under existing law the School District would levy on principal residence property only that portion of the mills necessary to allow the School District to receive the full revenue per pupil foundation allowance permitted by the State.

As a restoration and extension of authority which expires with the 2019 levy, shall the limitation on the amount of taxes which may be imposed on taxable property in the Grosse Pointe Public School System, County of Wayne, Michigan, be increased by 19.00 mills ($19.00 per $1,000 of taxable value) to the extent such property is not statutorily exempt, for five (5) years, the years 2020 to 2024, inclusive, to provide funds for operating expenses of the school district? Of the 19.00 mills, no more than 7.8763 mills ($7.8763 per $1,000 of taxable value) would be levied on principal residences. This millage would raise approximately $22,283,000 in the first year of levy.

_____Yes _____NO

GROSSE POINTE PUBLIC SCHOOL SYSTEM

SINKING FUND PROPOSAL

This proposal would restore and extend the authority of the Grosse Pointe Public School System to levy a sinking fund millage last approved by voters in 2014 and which expired with the 2019 levy.

As a restoration and extension of authorization which expired with the 2019 levy, shall the Grosse Pointe Public School System, County of Wayne, Michigan, be authorized to levy 1.00 mill ($1.00 per $1,000 of taxable valuation) to create a sinking fund for the purpose of the construction or repair of school buildings, the improvement and development of sites, school security improvements, the acquisition or upgrading of technology or for other purposes to the extent permitted by law, by increasing the limitation on the amount of taxes which may be imposed on taxable property in the School District for a period of five (5) years, being the years 2020 to 2024, inclusive? Of the 1.00 mill, .9687 constitutes a renewal of the expired authorization. It is estimated that 1.00 mill ($1.00 per $1,000 of taxable valuation) would raise approximately $2,998,000 in the first year that it is levied.

(Under state law, sinking fund proceeds may not be used to pay teacher or administrator salaries.)

_____Yes _____NO -

What will happen if the Operating Millage Restoration and Extension Proposal is

not approved by voters?

What will happen if the Operating Millage Restoration and Extension Proposal is

not approved by voters?

If the Operating Millage Restoration and Extension Proposal is not approved by voters, the school district will lose approximately 25% of its operational budget. To maintain a balanced budget, the budget would be significantly reduced (25%).

-

What will happen if the Sinking Fund Proposal is not approved by voters?

What will happen if the Sinking Fund Proposal is not approved by voters?

If the Sinking Fund Proposal is not approved by voters, it will cause a loss of approximately $3 million of the $10 million it costs annually to maintain GPPSS schools.

-

Can Sinking Fund revenue be used for operating expenses, such as salaries?

Can Sinking Fund revenue be used for operating expenses, such as salaries?

No. Sinking funds cannot be used for operating costs, such as staff salaries and benefits.

-

What is a sinking fund?

What is a sinking fund?

A sinking fund is a pay-as-you-go method of generating tax revenue. As a matter of comparison, a sinking fund is like a savings account into which a school district can deposit voter-approved local millage to pay cash for building projects or repairs as they arise. Sinking funds are usually 5-10 years in length, are capped by law at 3.0 mills, and are not usually intended to finance major projects. The GPPSS proposal is a one mill, five-year request.

-

Who can vote in this bond proposal election?

Who can vote in this bond proposal election?

Residents of the Grosse Pointe Public School System who will be 18 years of age or older on Election Day and are registered to vote by November 5, 2019.

-

Where can I get information about voting (such as how to register, where to vote,

and absentee voting)?

Where can I get information about voting (such as how to register, where to vote,

and absentee voting)?

Go to the Michigan Voter Information website (www.michigan.gov/vote) or call the Clerk’s Office where you reside.

-

Do I need to update my voter registration?

Do I need to update my voter registration?

If you have changed your name or address since the last time you voted, you need to update your voter registration. Do this at any Secretary of State Office or at the Clerk’s Office where you reside.

-

Can I vote by absentee ballot?

Can I vote by absentee ballot?

Yes. Since voter approval of Proposal 3 in November 2018, registered voters do not need a reason to vote by absentee ballot. Any registered voter can request an absentee ballot application from their local Clerk’s Office or by going online to www.michigan.gov/vote and clicking on Absentee Voting in the left column. Absentee ballots will be available to voters after September 21.